Gone are the days when men used to make a living alone. Today, both men and women are shouldering the financial responsibility together, making headway in this tough economic times. This is also where financial planning and budgeting comes into the picture. In order to be able to make informed decisions, you need to know where all the money is coming from, where it is going, and how you can manage it better to achieve your life goals. After all, if you are doing everything else together, why not budget together too? Also, it is a lot easier than opening a joint account which can be cumbersome.

While there are many budgeting apps available to help you with this, we will be focusing on budget apps for couples to manage their personal finances. Because like everything else, it needs two to tango!

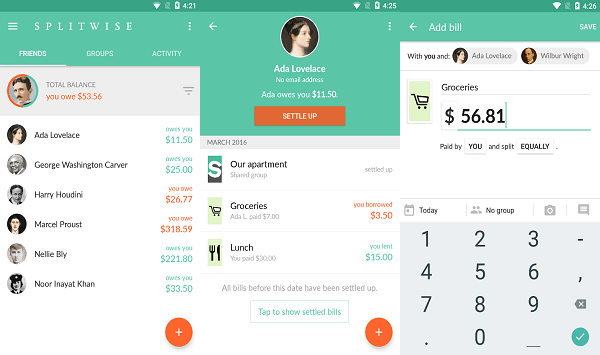

1. Splitwise

Different couples have different needs and goals. This is why first up on the list is a simple app called Splitwise. This is for couples who are new in their relationship and want to split their bills equally no matter the occasion. A popular app which is also used by groups of friends to split their bills equally.

Sign up with Google, and you can then use it for holidays, rent, dinner, shopping, and other occasions where you think the bill should be split. It will keep track of balances so you know who owes who how much!

Sign up with Google, and you can then use it for holidays, rent, dinner, shopping, and other occasions where you think the bill should be split. It will keep track of balances so you know who owes who how much!

Splitwise is available on both Android and iOS platform making it easier to manage accounts and keep everything in sync.

Splitwise Link: Site | Android | iOS

Also Read: 7 Best Personal Finance Software for Mac and iPhone

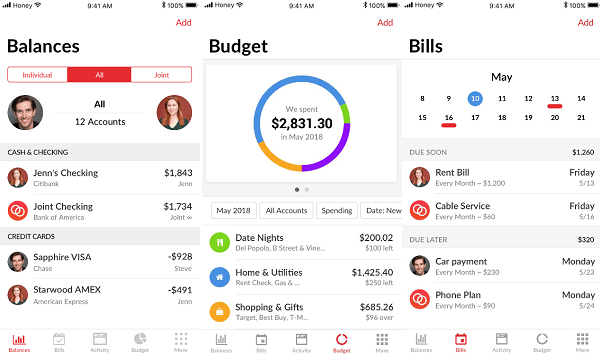

2. Honeydue

Honeydue is for couples who are looking for a full-fledged budgeting app to manage their personal finance. It will connect with all your bank accounts to pull balances and accounting entries. You can then create categories and set monthly budgets to see how you fare.

Enter important due dates so you will never forget to pay a bill on time again. What I found amusing was the use of emojis! Whenever your partner spends on something, you can approve or disapprove using one of the six emojis. Give her/him a thumbs up for that new carpet.

Since a lot of important data is exchanging hands, Honeydue encrypts all the data and offers multi-factor authentication for peace of mind.

Honeydue is free to use and available for both Android and iOS users which will keep both of you on the same page.

Honeydue Link: Site | Android | iOS

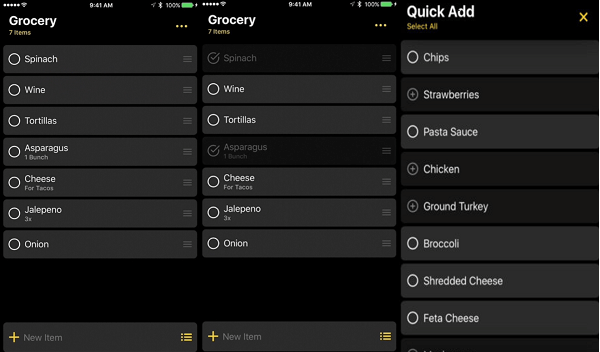

3. Grocery

When you are living together with your partner, your better half, one of the most common financial activity that you will do together is grocery shopping. It’s a necessity. What goes wrong here is that you don’t know what your partner is shopping for?

It may happen that you bought a certain item on your way back home and your partner bought the same thing! This is where Grocery app comes into the picture.

It’s a simple little free app that will allow you to create user accounts and lists of grocery items. You can then share these lists with each other and check off items as you buy them. Everything remains in sync.

There is direct support for Siri which will make it easy to add/delete items. You can add local stores to sync shopping data. The app is free to use but is only available on iOS platform for now.

Grocery Link: iOS

Also Read: 3 Best Money Management Apps for Android and iPhone

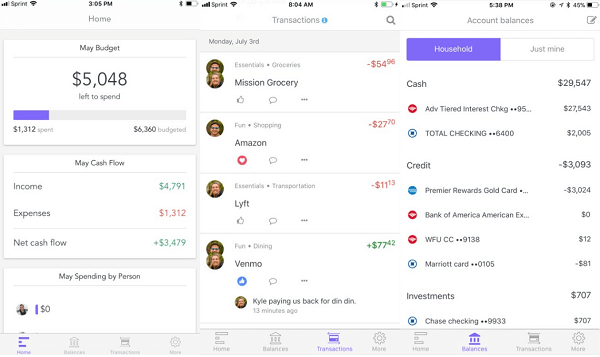

4. Honeyfi

Similar names, different functions. Well, not exactly but hear me out. Like Honeydue, Honeyfi will let you add all your bank accounts and credit cards but, big but, it will create your budget automatically. Why?

Because we keep postponing this vital task until it is too late. Accept it, you are lazy and boring and you have never created a budget in your life! The total budget amount will be distributed, using an algorithm, between different categories. Life, sorted.

Sharing is caring but sometimes, it can be embarrassing or even spell trouble. This is why there is an option to hide any transaction that you don’t want your significant other to see. Like a surprise birthday party? What were you thinking of hiding?

Like Honeydue, both of you will have separate accounts with all the data visible on a single screen. This means not only more transparency but also more accountability.

Honeyfi is free to use budget app for couples to manage personal finance and is ad-supported. It is available on both Android and iOS platforms and developers claim to have incorporated bank-level security.

Honeyfi Link: Site | Android | iOS

5. Dollarbird

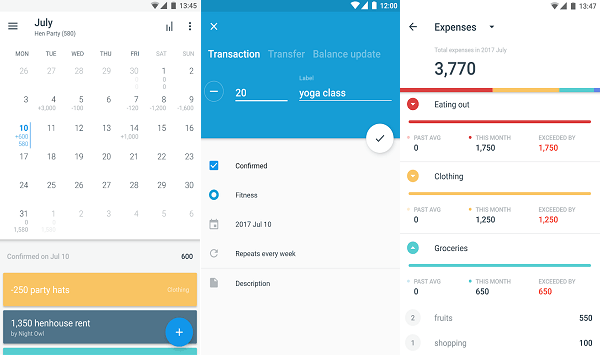

Dollarbird takes a slightly different but still effective approach to budget for couples to manage their personal finance. It comes with a calendar-based interface where you simply need to add events for every transaction that occurs on the day.

Transactions will be neatly and automagically categorized. At the end of the day, Dollarbird will calculate balances so you know who is spending on what and how much, and also how much you are left with.

The benefit of the calendar-based layout is that it will give you a bird’s eye view of your financial situation. Helpful for future budget planning. You can share the same calendar with other family members. You can also create more than one calendar but for a yearly subscription.

Dollarbird is available for free to download and use on both Android and iOS. It comes with in-app purchases but no ads.

Dollar Link: Site | Android | iOS

Related: 10 Android Apps to Learn Human Anatomy

Budget Apps for Couples

This is one of those old sayings that never goes out of fashion. Especially these days when it is so easy to get carried away and spend money on material things that you don’t need, want or even understand.

If you want to be rich, you need to invest but in order to invest, you must first save and in order to save, you must first budget. Try one of these budget apps for couples to manage your personal finance.

I was also looking for this kind of app and found a very simple and easy app for this purpose. It will help you to manage your budget. Just check it.

https://play.google.com/store/apps/details?id=in.usefulapp.timelybills&hl=en